Verification of Eligibility for Exchange Coverage Subsidies Delayed

Filed under: Health Care ReformThe Affordable Care Act (ACA) requires each state to have a competitive marketplace, known as an Affordable Health Insurance Exchange (Exchange), for individuals and small businesses to purchase private health insurance. All Exchanges will launch open enrollment in October 2013 with coverage becoming effective as early as Jan. 1, 2014.

On July 5, 2013, the Department of Health and Human Services (HHS) released a final rule addressing verification of eligibility for Exchange coverage subsidies. In the final rule, HHS announced that Exchanges will not be required to perform comprehensive verifications of income or eligibility for employer-sponsored coverage. Instead, the rules provide that:

- Exchanges can verify income eligibility on a random basis in 2014; and

- State-based Exchanges will not be required to perform random verification of employer-sponsored coverage until 2015.

BACKGROUND

States have a few options available to them with respect to the establishment of their Exchanges. A state may:

- Create and operate its own state-based Exchange;

- Have HHS operate the federally-facilitated Exchange (FFE) for its residents; or

- Partner with HHS so that the state is involved with the operation of the FFE.

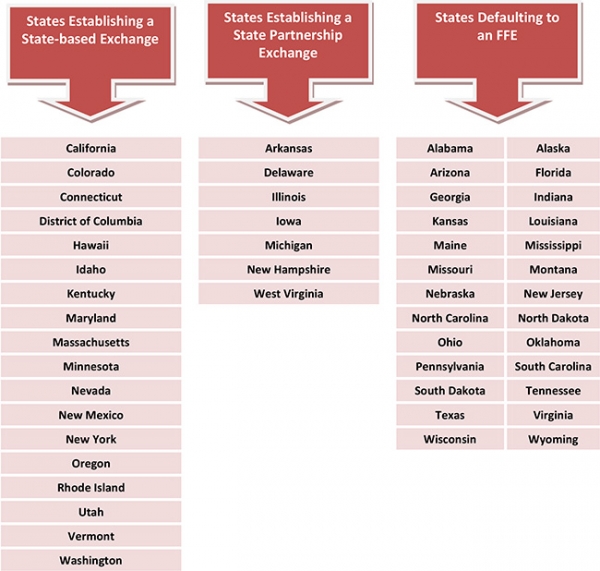

For 2014, 17 states and the District of Columbia have been conditionally approved to operate their own state-based Exchanges, seven states have been conditionally approved for partnership Exchanges, and 26 states have opted to have HHS run the Exchange in their state. See the chart on Page 3 for information on each state's Exchange decision.

Health Insurance Subsidies

Beginning in 2014, federal subsidies will be available to help individuals purchase health insurance through an Exchange. The subsidies are designed to make coverage through an Exchange more affordable by reducing out-of-pocket health care costs.

There are two federal health insurance subsidies available: premium tax credits and costsharing reductions. Premium tax credits are available for individuals with income of between 100 percent and 400 percent of the federal poverty line (FPL). Reduced cost-sharing is available for individuals with lower incomes (up to 250 percent of FPL).

To be eligible for the subsidies, a taxpayer:

- Must have household income for the year within the limits described above;

- May not be claimed as a tax dependent of another taxpayer; and

- Must file a joint return, if married.

In addition, to receive the premium assistance, a taxpayer must enroll in one or more qualified health plans (QHPs) through an Exchange. The taxpayer also cannot be eligible for minimum essential coverage (such as coverage under a government-sponsored program or an eligible employer-sponsored plan that is affordable and provides minimum value).

EXCHANGE VERIFICATION

In order to determine eligibility for health insurance subsidies, proposed rules would have required Exchanges to verify whether individuals who are applying for subsidies were eligible for (or enrolled in) employer-sponsored coverage on a random basis. In addition, the proposed rules would have required Exchanges to verify each applicant's household income. The final rule, however, allows Exchanges to rely on an applicant's attestation in most cases.

Eligibility for Employer-sponsored Coverage

Individuals who are applying for premium tax credits or cost-sharing reductions will be required to provide certain information to the Exchange about health insurance coverage provided by his or her employer. Under the final rule, the Exchange will perform a very limited verification of the individual's attestation.

The Exchange will only be required to perform random checks on applicants' attestations in cases where verifying information is not readily available (for example, through an online database). In these cases, the Exchange will notify the applicant and then contact the employer to verify the information. If an applicant's attestation is not part of the random sample, or if the

employer does not respond, the Exchange will rely on the applicant's attestation.

The final rule provides that HHS will offer to perform this verification procedure for states that are establishing a state-based Exchange, but will not be able to do so until 2015. As a result, these states will not be required to randomly verify employer-sponsored coverage until 2015.

Income Eligibility

Under the final rule, the Exchange will verify each applicant's claimed income against tax and Social Security records. If records show that an applicant's income is lower than what he or she claimed, the applicant's attestation will be accepted. If records show that the applicant's income is greater than his or her claimed income by a "significant amount," the Exchange will be required to verify the attestation.

In 2014 only, the final rule allows Exchanges to perform random checks, instead of comprehensive verification, in cases where an applicant claims a decrease in income and verifying electronic information is not readily available. The Exchange can accept attestations from applicants who are not part of the random sample. Additionally, if electronic information is unavailable for more than 24 hours after an application, the final rule allows the Exchange to determine eligibility based on information provided by the applicant, subject to further verification.

According to HHS, this transition rule is available for 2014 only because more and better data is expected to be available in future years.

STATE EXCHANGE DECISIONS

For 2014, 17 states and the District of Columbia have been conditionally approved to operate their own state-based Exchanges, seven states have been conditionally approved for partnership Exchanges, and 26 states have opted to have HHS run the Exchange in their state.

This Legislative Brief is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

© 2013 Zywave, Inc. All rights reserved. BK 7/13

The Loop Archives

- Healthcare Reform Update

- Concierge Medicine: The Answer to the “Patient Mill”?

- Pay or Play Penalty – Affordability Safe Harbors

- ACA Mandates — Different Measures of Affordability

- Q&As on Medical Loss Ratio Rules

- Medical Loss Ratio Rules

- White House Announces Transition Policy for Canceled Health Plans

- Taxes and Fees under the Affordable Care Act

- Health FSAs — Changes for 2014

- Health Insurance Exchanges: Multi-state Plans

- Health Reimbursement Arrangements (HRAs) — Changes for 2014

- Reinsurance Fees — Possible Exemption for Certain Self-insured Plans

- Final Rule Issued on Exchanges, Premium Stabilization Programs and Market Standards

- New Exemption from the Individual Mandate for Exchange Enrollees

- Insurance Marketing Nondiscrimination Reforms for 2014

- Health Care Reform Fees – Special Rules for HRAs

- FAQs on the Use of Exchanges for Ancillary Insurance Products

- Employer Penalties – Multi-employer Plans

- Transition Relief for Expatriate Health Plans

- Small Business Health Options Program (SHOP) and Multi-state Plans

- Health Care Reform – The Individual Mandate

- Model COBRA Election Notice Updated for ACA Changes

- Final Rules on Workplace Wellness Programs

- Effect on HRA Contributions and Wellness Program Incentives on Affordability

- Rating Restrictions for Health Insurance Premiums

- Pediatric Dental Care Coverage

- Defined Contribution Health Plans

- Exchange Eligibility Rules for Medicare Beneficiaries

- Deal to End the Government Shutdown and its Impact on Health Care Reform

- Small Employer Health Care Tax Credit: Changes for 2014

- Limits on Out-of-Pocket Maximums: Full Compliance Delayed for Some Health Plans

- FAQ on Exchange Notice Penalties

- Proposed Rules Released on Reporting for Issuers and Self-funded Employers

- IRS Issues Final Rules on Individual Mandate Penalties

- Agencies Release Guidance on HRAs, Health FSAs and Cafeteria Plans

- The Basic Health Program (BHP)

- HHS Announces Delay of Certain FF-SHOP Functions

- Impact of the Government Shutdown on Health Care Reform

- Verification of Eligibility for Exchange Coverage Subsidies Delayed

- IRS Guidance on Delay of Employer Mandate Penalties and Reporting Requirements

- Employer Reporting of Health Plan Coverage – Code Section 6055 and 6056

- Reporting Requirements for Employers and Health Plans

- Final Rule on Individual Mandate Exemptions and Minimum Essential Coverage

- The Hardship Exemption from the Individual Mandate

- IRS Issues Proposed Rules on Large Employer Reporting Requirements

- Metal Levels for Qualified Health Plans

- Communication Impediments: Are You a 'Cognitive Miser'?

- Networking for Intellectual Capital

- Release of 2012 Advice Memo Pulls Together Principles Applied by the NLRB in Evaluating Employer Social Medial Policies

- Talking About Health Care Insurance

- Email Etiquette

- Culture: Here’s Why It Matters Now More Than Ever Before

- The Impact of the Inflation Reduction Act on Medicare Prescription Coverage

- Wellness Programs: A Tool for Recruitment, Performance, and ROI

- The Impact of Flexible Work Arrangements on Employee Satisfaction

- Comprehensive Benefits Maximize Employee Engagement

- Common Mistakes with Retirement Plan Management

- HR Trends for 2025

- Data Driven Benefits for Retention

- Revamp Company Culture: A Wise Investment

- Why Offer Soft Skills Training?

- How To Improve Communication of Employee Benefits

- Employee Must-Have Benefits: Revamping the Old, Adding the New

- Employee Care: Wellness and Wellbeing

- Environmental and Sustainability Benefits For Workers

- The Care Factor: The Key to Worker Engagement, Productivity, and Loyalty

- Rising Healthcare Costs: How to Support Employees

- The Great Reshuffle

- Holistic Policies for Caregivers

- Flex-Work Trends

- How Pulse Surveys Can Improve Benefits

- Employers Offering “100% health plans”

- Lifestyle Support For Workers

- Cater Benefits to a Variety of Demographics

- Why Offer Wearables To Your Workforce?

- Improve Member Engagement with Online Portal Services

- Benefits to Attract Top Talent

- Inflation’s Impact on the Cost of Worker Benefits

- Align Family/Work-Life Balance Benefits With Business Goals

- Survey Workers Before Your Next Renewal

- Ways Employers Can Inflation-Proof Workforce Benefits

- Benefits That Help Avoid Employee Burnout

- Work Hour Expectations

- Pet Insurance: A Market with Opportunity

- Coming Back from Parental Leave: How Employers Can Support Workers

- Established Work From Home Benefits

- Benefits of Remote Physical Therapy

- Childcare Trends in the Workplace

- Build a Company Culture That Keeps Employees Happy

- Money Management: The Key To Saving For Retirement

- Popular Voluntary Benefits

- Employee Engagement Strategies

- Get Preventive Care Back on Track

- 2022 Trends: Still Working From Home or Back In the Office?

- Telehealth Trends in 2022

- The Future of Mobile Health Clinics

- Employee Assistance Program vs. Behavioral Health Coverage

- Using Debit Cards For Health Spending Accounts

- Productive Workspace at Home

- Popular Post-COVID Benefit: Pet Insurance

- Digital Eyestrain: Improve Productivity With Vision Benefits

- Short-Term Disability Insurance

- HSA-Approved Expenses For Mental Health

- Engagement Strategies For Remote Workers

- The Benefits of Ergonomics

- Managing Mental Health and Well-Being During COVID-19

- The Demise of One-Size-Fits-All Benefit Plans

- Why and How To Support Moms Back At Work

- Benefits To Help Workers Overcome Stress

- Future of Financial Wellness: Employer-Sponsored Savings Programs

- Convert Unused PTO Into Student Loan Benefit

- How To Maximize Vision Benefits For All Workers

- Prescription Drugs: Brand Name vs. Generic Coverage

- Long Term Care Hybrid Policies: Energizing the Life Insurance Market

- Retiree Medical Plans: What’s Happened to Lifetime Benefits?

- Birth of a New Trend: Commonly Covered Fertility Benefits

- Non-Physical Wellness Benefits: Mental and Financial

- Healthcare Employee Rewards Programs

- Volunteer PTO

- Janus vs AFSCME: Impact On Union-Sponsored Benefits

- Janus vs AFSCME: Impact On Union-Sponsored Benefits

- The True Value of Voluntary Benefits

- Long Term Disability: Big Value, Little Appreciation

- LTD vs. LTC Insurance

- Natural Disaster Leave

- The Underappreciated Cancer Benefit

- Putting Life Back Into Life Insurance

- Welcome Back: How to Support Workers Returning From Disability Leave

- 3 Ways Life Insurance Excels as a Benefit

- Dental Medical Bills

- Pros and Cons of Telemedicine

- Medicare Advantage on the Rise

- Long Term Care Insurance

- How Technology Can Simplify Healthcare Benefits

- The Case For Innovative Benefits

- Customized Benefits

- How Education Benefits Help Reduce Turnover

- Uber Health

- ERISA Disability Rule Update

- Medicare Advantage Update

- Update on Cadillac Tax

- How Group Critical Illness and Accident Plans Supplement Medical Benefits

- Understanding Health Savings Accounts

- Four Benefit Trends in 2018

- How to Engage Employees in Wellness

- Can Your Technology Platform Accommodate Your Benefit Package?

- How to Enhance Your Benefits Communication Efforts

- Most Popular Employee Benefits

- Should You Still Offer Health Insurance as a Benefit?

- How To Attract Top Talent

- Expensive Benefit Plan Penalties to Avoid

- Conditions That Drive Up Employer Healthcare Costs

- Trends in Company Culture

- Changes in Benefits Offerings

- Repeal and Replacement Prospects for Obamacare

- Recent Developments in Wellness Incentive Programs

- Imputed Income

- Reverse Discrimination in Employer Plans

- The Advantage of Mental Health Benefits

- Healthcare Cost Trend

- Saving For Healthcare Expenses

- Telehealth: Redesigning the Patient Experience

- Vision Exams and Insurance Benefits

- Family Medical Leave Act

- Healthcare Reform Updates

- Disability Insurance

- How to Determine Life Insurance Needs

- Pros and Cons of Bundled Benefits

- Value Based Plan Design

- The Alphabet Soup of Medical Plans

- Medicare

- Retiree Medical Accounts

- Cadillac Tax: Implications and Unknowns

- The Facts About Medical Tourism

- The Buy-Up Solution to Curtailing Benefits

- What You Should Know About Prescription Drugs

- HDHP + HSA: A Versatile Savings Combination

- For Your Benefit: HRA, HCFSA and HSA Plans

- OSHA Proposes Rule Requiring Electronic Submission of Injury and Illness Reports

- Dental Insurance: What You Need to Know

- Voluntary Benefits: Adoption Assistance

- What Is Telemedicine?

- Final Rule Implementing Mental Health Parity Requirements

- Senate Passes Gay Rights Legislation

- IRS Clarifies Transition Relief for Cafeteria Plan Elections

- Changes to “Use-or-lose” Rule for Health Flexible Spending Accounts (FSAs)

- EEOC Settles First Genetic Discrimination Lawsuit

- Supreme Court Strikes Down DOMA, Clears Way for Same-Sex Marriage in California

- Supreme Court Limits Employment Discrimination and Retaliation Claims

- Supreme Court Ruling on DOMA – What It Means for Employers

- The Subjectivity of Employee Benefits

- Model HIPAA Privacy Notices Released

- IRS Procedures to Correct Overpayments on Taxes for Same-sex Spouse Benefits

- Limits on Out-of-Pocket Maximums: Full Compliance Delayed for Some Health Plans

- IRS to Recognize All Legal Same-sex Marriages for Federal Tax Purposes

- Guidance Released on Same-sex Marriage Under ERISA

- Work Is Not a Noun; It's a Verb

- Coping With Flu Season: 3 Tips to Encourage Sick Workers to Stay Home

- Attract and Retain: What Does “Gen Next” Want?

- Retention and Attraction: Cherish or Perish

- The Resilient and the Restless

- How to Attract and Retain Quality Workers in an Environment Poised for Turnover

- A Checklist for Hiring the Very Best Talent

- Employees Make It Clear: Here's What They Need to Really Be Engaged