Saving For Healthcare Expenses

Filed under: BenefitsThe good news is that healthcare spending in the U.S. is growing at a slower pace than in previous years. Costs are still increasing, they're just increasing at a reduced pace than in recent years. In fact, this year's annual increase, at 4.7 percent, is the lowest since 2001 and a far cry from the years when spending spiked to 9 percent. Unfortunately, that pace is still two times higher than the average family's annual income growth.

According to this year's Milliman Medical Index, the average American family of four currently spends upwards of $25,000 a year on healthcare. That sum includes premiums and all out-of-pocket expenses, such as co-pays, deductibles, and co-insurance.

For better or worse, the Patient Protection and Affordable Care Act (PPACA) launched a starting point for healthcare reform in this country. While more than half of Americans get subsidized health insurance through their employers, that doesn't mean their healthcare is hassle free. They also are impacted by rising premiums, escalating prescription drug prices, and increasing deductibles. Health insurance may be more universal, but it's also become more expensive.

The issue is intensified by employers transferring a larger share of healthcare costs to their workers. In 2001, employers paid about 61 percent of costs; today that share has dropped to 57 percent. However, during this timeframe several types of accounts have become popular to help workers save and pay for medical expenses with tax-free earnings.

These plans include the Health Savings Account (HSA), Health Reimbursement Account (HRA), and Flexible Savings Account (FSA).

HDHP + HSA

Health Savings Accounts (HSAs) were established as part of the Medicare Prescription Drug Improvement and Modernization Act of 2003. The HSA was originally adopted by self-employed workers who had to pay the full cost of their own insurance. To do so, most purchased high deductible healthcare plans (HDHP) to take advantage of lower premiums. HSAs were introduced as an add-on for HDHPs as a way to save money earmarked for medical expenses on a tax-advantaged basis. The plans quickly became popular and soon employers began to offer them to their workforce in conjunction with the lower-cost HDHP plans. Today, 24 percent of workers (employed by companies with two to 5,000+ covered members) are enrolled in a high-deductible health plan (HDHP) with an HSA or reimbursement account.

Tax breaks are a huge advantage to HSAs:

• Pay no taxes on money contributed

• Money grows tax-deferred

• No taxes are due when funds are used to pay eligible medical expenses

• Account owners pay no income or capital gains taxes on any distributions once they turn age 65

In fact, the only way taxes are due on HSA savings is if the money is used before age 65 for any reason other than to pay for qualified healthcare expenses. In that case, the account owner also will be liable for a 20 percent penalty on the funds used for nonqualified expenses.

In 2016, the combined annual contribution limit for employers and workers is $3,350 for individuals and $6,750 for families. Folks age 55 and up may add another $1,000 each year.

Older individuals may no longer contribute to an HSA once they have registered for Medicare, but they can still use the money in their HSA for medical expenses such as co-payments, deductibles, vision and dental care, and a portion of long-term-care premiums (based on age). The funds also can be used to pay for Medicare Part B, Part D, or Medicare Advantage premiums (but not Medigap premiums).

The HSA is an ideal pairing for a high deductible health plan because you can pay for medical expenses tax-free until you meet the deductible, at which point the insurance plan will kick in. One of the perks of the health savings account is that it belongs to the worker even if he leaves his employer, and he can use it in subsequent years – there's no deadline.

HRA

Many HDHPs also can be combined with a health reimbursement arrangement. An HRA is similar to an HSA but it is owned by the employer, not the worker. With an HRA, an employer funds an individual reimbursement account for each participating employee and decides how much to contribute each year. As the plan sponsor, the employer defines what those funds can be used for – such as copays, coinsurance, deductibles, and services not fully covered by the insurance plan – as well as whether or not the funds will roll over from year to year. When a worker leaves the company, the employer retains the funds in the account.

FSA

Unlike an HRA, a flexible spending account is funded only by worker salary deferrals, and his contributions are not taxed as long as the funds are used to reimburse qualifying expenses. Some plan sponsors provide an FSA debit card that enables the eligible expenses to be automatically deducted from the account, so there's no paperwork to be filed or waiting for reimbursements. Each employer determines the annual contribution limit, subject to federal restrictions; in 2016 the maximum limit is $2,500. Note that the FSA is not portable; it is retained by the employer.

Until recent years, money in an FSA had to be used by the end of the year or it defaulted to the plan sponsor. In 2013, the Treasury Department made the following changes:

• A grace period was introduced to permit workers an additional two-and-a-half months to incur new expenses using prior-year FSA funds. At the end of the grace period, all unspent funds are forfeited.

• A carryover provision was introduced so that workers can roll over up to $500 of unused FSA dollars to the next year; any remaining amount above $500 is forfeited at year-end.

Note that plan sponsors may offer either the carryover feature or the grace period, but not both.

• FSAs also may provide a "run-out period" of 90 days beyond the end of the plan year, during which time workers may request reimbursement for expenses incurred during the previous plan year. After this time, all remaining money is forfeited.

FSAs that offer a carryover option and a run-out period will deduct run-out expenses from the $500 carryover amount, and any remaining carryover will still be available. For example, if the account holder carries over $500 dollars and submits $200 in run-out expenses, he or she will have $300 remaining in carryover funds for the ensuing plan year.

Note that the grace period and run-out period overlap, so even if a plan offers both, all expenses must be claimed before the period ends. At that point, any un-used funds are forfeited.

Spending Tips for Leftover FSA Dollars

Naturally, it's a good idea to use up all the money in an FSA rather than forfeiting it, but workers can't always plan when they'll get sick. However, employers can help by reminding them of some of the ways to use this available money by year end, such as:

• Purchasing eligible healthcare products such as first-aid kits, hot and cold therapy packs, breast pumps, and contact lenses

• Scheduling ancillary healthcare visits with dentists, ophthalmologists, chiropractors, and acupuncturists.

• Using account funds to pay for healthcare services for a spouse and qualified children.

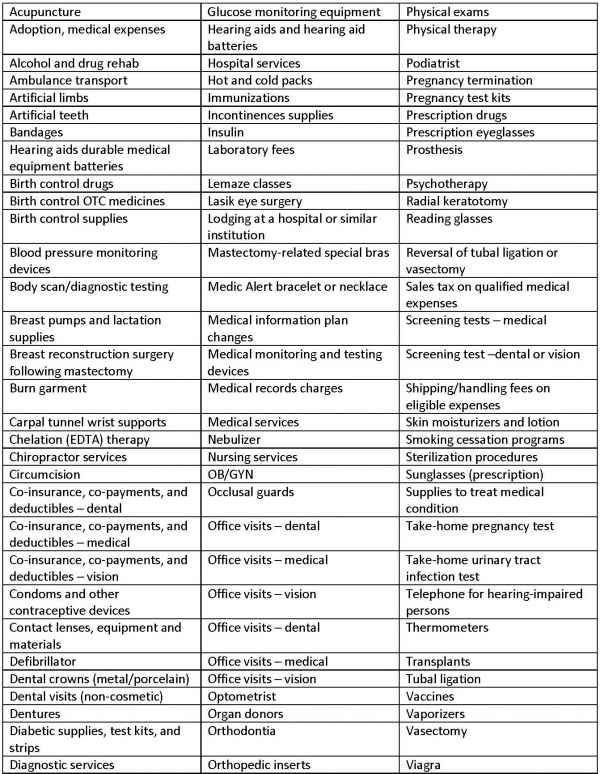

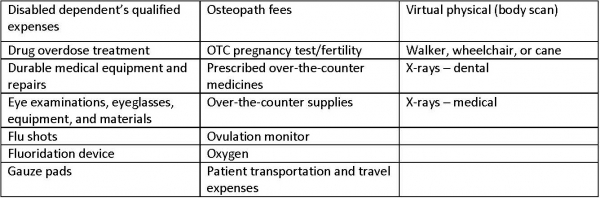

Eligible Expenses for an HRA and Standard FSA

The following is a list of medical expenses that can be paid for with funds from an HRA and Standard FSA. Note that not all of the expenses listed below are eligible under all plans. Workers should refer to their Summary Plan Description (SPD) to find out which expenses are eligible under their plan. Other healthcare expenses also may qualify depending upon the situation.

The Loop Archives

- Healthcare Reform Update

- Concierge Medicine: The Answer to the “Patient Mill”?

- Pay or Play Penalty – Affordability Safe Harbors

- ACA Mandates — Different Measures of Affordability

- Q&As on Medical Loss Ratio Rules

- Medical Loss Ratio Rules

- White House Announces Transition Policy for Canceled Health Plans

- Taxes and Fees under the Affordable Care Act

- Health FSAs — Changes for 2014

- Health Insurance Exchanges: Multi-state Plans

- Health Reimbursement Arrangements (HRAs) — Changes for 2014

- Reinsurance Fees — Possible Exemption for Certain Self-insured Plans

- Final Rule Issued on Exchanges, Premium Stabilization Programs and Market Standards

- New Exemption from the Individual Mandate for Exchange Enrollees

- Insurance Marketing Nondiscrimination Reforms for 2014

- Health Care Reform Fees – Special Rules for HRAs

- FAQs on the Use of Exchanges for Ancillary Insurance Products

- Employer Penalties – Multi-employer Plans

- Transition Relief for Expatriate Health Plans

- Small Business Health Options Program (SHOP) and Multi-state Plans

- Health Care Reform – The Individual Mandate

- Model COBRA Election Notice Updated for ACA Changes

- Final Rules on Workplace Wellness Programs

- Effect on HRA Contributions and Wellness Program Incentives on Affordability

- Rating Restrictions for Health Insurance Premiums

- Pediatric Dental Care Coverage

- Defined Contribution Health Plans

- Exchange Eligibility Rules for Medicare Beneficiaries

- Deal to End the Government Shutdown and its Impact on Health Care Reform

- Small Employer Health Care Tax Credit: Changes for 2014

- Limits on Out-of-Pocket Maximums: Full Compliance Delayed for Some Health Plans

- FAQ on Exchange Notice Penalties

- Proposed Rules Released on Reporting for Issuers and Self-funded Employers

- IRS Issues Final Rules on Individual Mandate Penalties

- Agencies Release Guidance on HRAs, Health FSAs and Cafeteria Plans

- The Basic Health Program (BHP)

- HHS Announces Delay of Certain FF-SHOP Functions

- Impact of the Government Shutdown on Health Care Reform

- Verification of Eligibility for Exchange Coverage Subsidies Delayed

- IRS Guidance on Delay of Employer Mandate Penalties and Reporting Requirements

- Employer Reporting of Health Plan Coverage – Code Section 6055 and 6056

- Reporting Requirements for Employers and Health Plans

- Final Rule on Individual Mandate Exemptions and Minimum Essential Coverage

- The Hardship Exemption from the Individual Mandate

- IRS Issues Proposed Rules on Large Employer Reporting Requirements

- Metal Levels for Qualified Health Plans

- Communication Impediments: Are You a 'Cognitive Miser'?

- Networking for Intellectual Capital

- Release of 2012 Advice Memo Pulls Together Principles Applied by the NLRB in Evaluating Employer Social Medial Policies

- Talking About Health Care Insurance

- Email Etiquette

- Culture: Here’s Why It Matters Now More Than Ever Before

- Rising Healthcare Costs: How to Support Employees

- The Great Reshuffle

- Holistic Policies for Caregivers

- Flex-Work Trends

- How Pulse Surveys Can Improve Benefits

- Employers Offering “100% health plans”

- Lifestyle Support For Workers

- Cater Benefits to a Variety of Demographics

- Why Offer Wearables To Your Workforce?

- Improve Member Engagement with Online Portal Services

- Benefits to Attract Top Talent

- Inflation’s Impact on the Cost of Worker Benefits

- Align Family/Work-Life Balance Benefits With Business Goals

- Survey Workers Before Your Next Renewal

- Ways Employers Can Inflation-Proof Workforce Benefits

- Benefits That Help Avoid Employee Burnout

- Work Hour Expectations

- Pet Insurance: A Market with Opportunity

- Coming Back from Parental Leave: How Employers Can Support Workers

- Established Work From Home Benefits

- Benefits of Remote Physical Therapy

- Childcare Trends in the Workplace

- Build a Company Culture That Keeps Employees Happy

- Money Management: The Key To Saving For Retirement

- Popular Voluntary Benefits

- Employee Engagement Strategies

- Get Preventive Care Back on Track

- 2022 Trends: Still Working From Home or Back In the Office?

- Telehealth Trends in 2022

- The Future of Mobile Health Clinics

- Employee Assistance Program vs. Behavioral Health Coverage

- Using Debit Cards For Health Spending Accounts

- Productive Workspace at Home

- Popular Post-COVID Benefit: Pet Insurance

- Digital Eyestrain: Improve Productivity With Vision Benefits

- Short-Term Disability Insurance

- HSA-Approved Expenses For Mental Health

- Engagement Strategies For Remote Workers

- The Benefits of Ergonomics

- Managing Mental Health and Well-Being During COVID-19

- The Demise of One-Size-Fits-All Benefit Plans

- Why and How To Support Moms Back At Work

- Benefits To Help Workers Overcome Stress

- Future of Financial Wellness: Employer-Sponsored Savings Programs

- Convert Unused PTO Into Student Loan Benefit

- How To Maximize Vision Benefits For All Workers

- Prescription Drugs: Brand Name vs. Generic Coverage

- Long Term Care Hybrid Policies: Energizing the Life Insurance Market

- Retiree Medical Plans: What’s Happened to Lifetime Benefits?

- Birth of a New Trend: Commonly Covered Fertility Benefits

- Non-Physical Wellness Benefits: Mental and Financial

- Healthcare Employee Rewards Programs

- Volunteer PTO

- Janus vs AFSCME: Impact On Union-Sponsored Benefits

- Janus vs AFSCME: Impact On Union-Sponsored Benefits

- The True Value of Voluntary Benefits

- Long Term Disability: Big Value, Little Appreciation

- LTD vs. LTC Insurance

- Natural Disaster Leave

- The Underappreciated Cancer Benefit

- Putting Life Back Into Life Insurance

- Welcome Back: How to Support Workers Returning From Disability Leave

- 3 Ways Life Insurance Excels as a Benefit

- Dental Medical Bills

- Pros and Cons of Telemedicine

- Medicare Advantage on the Rise

- Long Term Care Insurance

- How Technology Can Simplify Healthcare Benefits

- The Case For Innovative Benefits

- Customized Benefits

- How Education Benefits Help Reduce Turnover

- Uber Health

- ERISA Disability Rule Update

- Medicare Advantage Update

- Update on Cadillac Tax

- How Group Critical Illness and Accident Plans Supplement Medical Benefits

- Understanding Health Savings Accounts

- Four Benefit Trends in 2018

- How to Engage Employees in Wellness

- Can Your Technology Platform Accommodate Your Benefit Package?

- How to Enhance Your Benefits Communication Efforts

- Most Popular Employee Benefits

- Should You Still Offer Health Insurance as a Benefit?

- How To Attract Top Talent

- Expensive Benefit Plan Penalties to Avoid

- Conditions That Drive Up Employer Healthcare Costs

- Trends in Company Culture

- Changes in Benefits Offerings

- Repeal and Replacement Prospects for Obamacare

- Recent Developments in Wellness Incentive Programs

- Imputed Income

- Reverse Discrimination in Employer Plans

- The Advantage of Mental Health Benefits

- Healthcare Cost Trend

- Saving For Healthcare Expenses

- Telehealth: Redesigning the Patient Experience

- Vision Exams and Insurance Benefits

- Family Medical Leave Act

- Healthcare Reform Updates

- Disability Insurance

- How to Determine Life Insurance Needs

- Pros and Cons of Bundled Benefits

- Value Based Plan Design

- The Alphabet Soup of Medical Plans

- Medicare

- Retiree Medical Accounts

- Cadillac Tax: Implications and Unknowns

- The Facts About Medical Tourism

- The Buy-Up Solution to Curtailing Benefits

- What You Should Know About Prescription Drugs

- HDHP + HSA: A Versatile Savings Combination

- For Your Benefit: HRA, HCFSA and HSA Plans

- OSHA Proposes Rule Requiring Electronic Submission of Injury and Illness Reports

- Dental Insurance: What You Need to Know

- Voluntary Benefits: Adoption Assistance

- What Is Telemedicine?

- Final Rule Implementing Mental Health Parity Requirements

- Senate Passes Gay Rights Legislation

- IRS Clarifies Transition Relief for Cafeteria Plan Elections

- Changes to “Use-or-lose” Rule for Health Flexible Spending Accounts (FSAs)

- EEOC Settles First Genetic Discrimination Lawsuit

- Supreme Court Strikes Down DOMA, Clears Way for Same-Sex Marriage in California

- Supreme Court Limits Employment Discrimination and Retaliation Claims

- Supreme Court Ruling on DOMA – What It Means for Employers

- The Subjectivity of Employee Benefits

- Model HIPAA Privacy Notices Released

- IRS Procedures to Correct Overpayments on Taxes for Same-sex Spouse Benefits

- Limits on Out-of-Pocket Maximums: Full Compliance Delayed for Some Health Plans

- IRS to Recognize All Legal Same-sex Marriages for Federal Tax Purposes

- Guidance Released on Same-sex Marriage Under ERISA

- Work Is Not a Noun; It's a Verb

- Coping With Flu Season: 3 Tips to Encourage Sick Workers to Stay Home

- Attract and Retain: What Does “Gen Next” Want?

- Retention and Attraction: Cherish or Perish

- The Resilient and the Restless

- How to Attract and Retain Quality Workers in an Environment Poised for Turnover

- A Checklist for Hiring the Very Best Talent

- Employees Make It Clear: Here's What They Need to Really Be Engaged