Long Term Care Insurance

Filed under: BenefitsPresently, private insurance pays for only seven percent of the $300 billion U.S. spend on long-term support and services (LTSS), including nursing home facilities and home-based care. The USC Leonard Davis School of Gerontology predicts that by 2025, one half of Americans will pay for LTSS expenses out-of-pocket.

Not only are people living longer today, but they are working longer. Fortunately, work helps minds and bodies stay engaged on a day-to-day basis with a social network. This is a key component to warding off problems that tend to accompany retirement, such as inertia, isolation, and dementia.

The good news is that the longer people are able to work, the less time they'll spend idle in retirement. However, the longer people live, the more likely they'll need assisted living services toward the end of their life. The question is, how will they pay for long term care?

Employer Benefits

In all likelihood, the U.S. will need to explore multiple solutions for widespread, insurance-based long term care coverage, utilizing the strengths of both the private and public sectors. According to the U.S. Department of Health and Human Services, about 40 percent of employers offer some form of long term care insurance (LTCI), many on a voluntary basis.

Large employers with more than 500 workers generally offer what is referred to as a "true group" LTCI policy, which is traditional long term care insurance. Small and medium-sized companies tend to favor what are called "multi-life" LTCI packages, which are individual long term care insurance policies bundled together and offered at a discount. Multi-life policies also are available for a worker's spouse and parents in an effort to cover as many lives as possible. Note, however, that this type of policy typically has more stringent medical underwriting criteria.

In most cases, workers pay the full premium. However, recognizing that they're not likely to enjoy the benefit for years or decades in the future, only two percent of workers take advantage of this benefit.

And yet, the long term care benefit in one form or another is on the brink of becoming highly valued as the workforce grows older and older workers continue working. It is important that employers offer benefits that specifically appeal to older workers to balance those that appeal to younger ones, such as popular tuition reimbursement and student loan repayment programs.

Moreover, long term care offers low-cost value, since it is largely paid for by workers themselves. From an employer perspective, offering group long-term care insurance provides three primary benefits:

• Enhances recruiting and retention efforts with an insurance coverage gap not included in medical or disability insurance

• Improves worker productivity by offering access to resources that will help them manage long-term care for a family member

• Employer contributions to long-term care premiums are deductible as a business expense

The Value of LTCI Benefits

Regular health insurance covers only acute care, such as rehabilitation after a hospital stay. It is not designed to cover the cost of assistance over a long period of time. Therefore, longer term care expenses must be paid for out-of-pocket unless the worker is eligible for government benefits or has previously purchased some form of long term care insurance. (Since LTCI requires underwriting, policies are not generally approved after need is established).

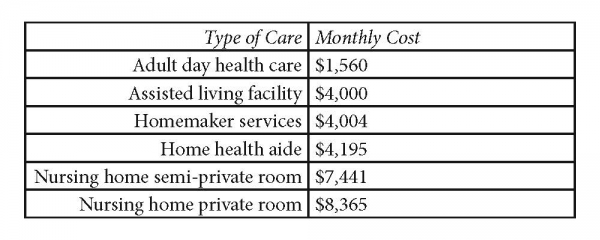

The problem is that long term care can be very expensive. While fees vary based on location and other benefits, according to Genworth's 2018 Cost of Care Survey the following are national averages for various types of long term care services.

Long Term Care Insurance

One of the primary reasons to purchase long term care insurance is to protect household finances. In other words, if an entire savings nest egg is used up paying for care of one disabled spouse, little will be left for the other spouse to carry on.

The policy itself typically covers the cost of daily care for a person with a chronic illness, disability, or conditions associated with aging. The contract may be structured either as an indemnity – which pays out a fixed sum for any use – or as reimbursement for payments made to a nursing home, assisted living facility, for home health care or some combination thereof.

Typically, a policyowner qualifies for LTCI benefits when his physician verifies that he needs help with at least two of the following "activities of daily living" (ADLs):

• Personal care, such as bathing, grooming, oral, nail and hair care

• Using the bathroom

• Dressing

• Feeding oneself

• Moving from one position to another and/or walking

An LTCI policy may have a waiting period before coverage kicks in (e.g., 90 days) and there is generally a limit to how long coverage lasts (e.g., three years).

Health Savings Account

Employers also may encourage workers to save for LTCI expenses in retirement through a health savings account (HSA) offered in conjunction with a high deductible health insurance plan. An HSA is funded via worker and/or employer tax-deferred contributions and can be used to pay premiums for long term care insurance and for actual long term care services, such as:

• In-patient hospital care

• Residential nursing home care for medical reasons

• In-home nursing services connected with patient care

• In-home care (only the portion of the expense paid for direct medical care)

Hybrid Insurance

Another way to pay for long term care is through a combined benefit with a life insurance policy. For example, a whole or universal life insurance policy may offer:

• A long term care rider for an additional fee

• Terminal illness benefits that distribute a portion of the policy's death benefit when a policyowner is diagnosed with a terminal illness or cognitive impairment

• Accelerated benefits that distribute a portion of the policy's death benefit for long term care

Annuity Option

In recent years, annuity contracts have started permitting withdrawals specifically for long term care expenses from the policy's cash account value or through increased income benefits. Some annuities have added new features, such as a Long Term Care Doubler or a Home Health Care Doubler, which increase the lifetime income benefit for a limited time or the duration of stay in a long term care facility. These payouts enjoy income tax-free status.

Older workers who are healthy enough to work past traditional retirement age may also live a longer life. This means at some point they may well need assisted-living or long-term care. Whether offering an insurance option or long-term savings vehicle, many employers are committed to helping workers prepare for late-stage retirement with dignity and as much independence as possible.

The Loop Archives

- Healthcare Reform Update

- Concierge Medicine: The Answer to the “Patient Mill”?

- Pay or Play Penalty – Affordability Safe Harbors

- ACA Mandates — Different Measures of Affordability

- Q&As on Medical Loss Ratio Rules

- Medical Loss Ratio Rules

- White House Announces Transition Policy for Canceled Health Plans

- Taxes and Fees under the Affordable Care Act

- Health FSAs — Changes for 2014

- Health Insurance Exchanges: Multi-state Plans

- Health Reimbursement Arrangements (HRAs) — Changes for 2014

- Reinsurance Fees — Possible Exemption for Certain Self-insured Plans

- Final Rule Issued on Exchanges, Premium Stabilization Programs and Market Standards

- New Exemption from the Individual Mandate for Exchange Enrollees

- Insurance Marketing Nondiscrimination Reforms for 2014

- Health Care Reform Fees – Special Rules for HRAs

- FAQs on the Use of Exchanges for Ancillary Insurance Products

- Employer Penalties – Multi-employer Plans

- Transition Relief for Expatriate Health Plans

- Small Business Health Options Program (SHOP) and Multi-state Plans

- Health Care Reform – The Individual Mandate

- Model COBRA Election Notice Updated for ACA Changes

- Final Rules on Workplace Wellness Programs

- Effect on HRA Contributions and Wellness Program Incentives on Affordability

- Rating Restrictions for Health Insurance Premiums

- Pediatric Dental Care Coverage

- Defined Contribution Health Plans

- Exchange Eligibility Rules for Medicare Beneficiaries

- Deal to End the Government Shutdown and its Impact on Health Care Reform

- Small Employer Health Care Tax Credit: Changes for 2014

- Limits on Out-of-Pocket Maximums: Full Compliance Delayed for Some Health Plans

- FAQ on Exchange Notice Penalties

- Proposed Rules Released on Reporting for Issuers and Self-funded Employers

- IRS Issues Final Rules on Individual Mandate Penalties

- Agencies Release Guidance on HRAs, Health FSAs and Cafeteria Plans

- The Basic Health Program (BHP)

- HHS Announces Delay of Certain FF-SHOP Functions

- Impact of the Government Shutdown on Health Care Reform

- Verification of Eligibility for Exchange Coverage Subsidies Delayed

- IRS Guidance on Delay of Employer Mandate Penalties and Reporting Requirements

- Employer Reporting of Health Plan Coverage – Code Section 6055 and 6056

- Reporting Requirements for Employers and Health Plans

- Final Rule on Individual Mandate Exemptions and Minimum Essential Coverage

- The Hardship Exemption from the Individual Mandate

- IRS Issues Proposed Rules on Large Employer Reporting Requirements

- Metal Levels for Qualified Health Plans

- Communication Impediments: Are You a 'Cognitive Miser'?

- Networking for Intellectual Capital

- Release of 2012 Advice Memo Pulls Together Principles Applied by the NLRB in Evaluating Employer Social Medial Policies

- Talking About Health Care Insurance

- Email Etiquette

- Culture: Here’s Why It Matters Now More Than Ever Before

- The Impact of the Inflation Reduction Act on Medicare Prescription Coverage

- Wellness Programs: A Tool for Recruitment, Performance, and ROI

- The Impact of Flexible Work Arrangements on Employee Satisfaction

- Comprehensive Benefits Maximize Employee Engagement

- Common Mistakes with Retirement Plan Management

- HR Trends for 2025

- Data Driven Benefits for Retention

- Revamp Company Culture: A Wise Investment

- Why Offer Soft Skills Training?

- How To Improve Communication of Employee Benefits

- Employee Must-Have Benefits: Revamping the Old, Adding the New

- Employee Care: Wellness and Wellbeing

- Environmental and Sustainability Benefits For Workers

- The Care Factor: The Key to Worker Engagement, Productivity, and Loyalty

- Rising Healthcare Costs: How to Support Employees

- The Great Reshuffle

- Holistic Policies for Caregivers

- Flex-Work Trends

- How Pulse Surveys Can Improve Benefits

- Employers Offering “100% health plans”

- Lifestyle Support For Workers

- Cater Benefits to a Variety of Demographics

- Why Offer Wearables To Your Workforce?

- Improve Member Engagement with Online Portal Services

- Benefits to Attract Top Talent

- Inflation’s Impact on the Cost of Worker Benefits

- Align Family/Work-Life Balance Benefits With Business Goals

- Survey Workers Before Your Next Renewal

- Ways Employers Can Inflation-Proof Workforce Benefits

- Benefits That Help Avoid Employee Burnout

- Work Hour Expectations

- Pet Insurance: A Market with Opportunity

- Coming Back from Parental Leave: How Employers Can Support Workers

- Established Work From Home Benefits

- Benefits of Remote Physical Therapy

- Childcare Trends in the Workplace

- Build a Company Culture That Keeps Employees Happy

- Money Management: The Key To Saving For Retirement

- Popular Voluntary Benefits

- Employee Engagement Strategies

- Get Preventive Care Back on Track

- 2022 Trends: Still Working From Home or Back In the Office?

- Telehealth Trends in 2022

- The Future of Mobile Health Clinics

- Employee Assistance Program vs. Behavioral Health Coverage

- Using Debit Cards For Health Spending Accounts

- Productive Workspace at Home

- Popular Post-COVID Benefit: Pet Insurance

- Digital Eyestrain: Improve Productivity With Vision Benefits

- Short-Term Disability Insurance

- HSA-Approved Expenses For Mental Health

- Engagement Strategies For Remote Workers

- The Benefits of Ergonomics

- Managing Mental Health and Well-Being During COVID-19

- The Demise of One-Size-Fits-All Benefit Plans

- Why and How To Support Moms Back At Work

- Benefits To Help Workers Overcome Stress

- Future of Financial Wellness: Employer-Sponsored Savings Programs

- Convert Unused PTO Into Student Loan Benefit

- How To Maximize Vision Benefits For All Workers

- Prescription Drugs: Brand Name vs. Generic Coverage

- Long Term Care Hybrid Policies: Energizing the Life Insurance Market

- Retiree Medical Plans: What’s Happened to Lifetime Benefits?

- Birth of a New Trend: Commonly Covered Fertility Benefits

- Non-Physical Wellness Benefits: Mental and Financial

- Healthcare Employee Rewards Programs

- Volunteer PTO

- Janus vs AFSCME: Impact On Union-Sponsored Benefits

- Janus vs AFSCME: Impact On Union-Sponsored Benefits

- The True Value of Voluntary Benefits

- Long Term Disability: Big Value, Little Appreciation

- LTD vs. LTC Insurance

- Natural Disaster Leave

- The Underappreciated Cancer Benefit

- Putting Life Back Into Life Insurance

- Welcome Back: How to Support Workers Returning From Disability Leave

- 3 Ways Life Insurance Excels as a Benefit

- Dental Medical Bills

- Pros and Cons of Telemedicine

- Medicare Advantage on the Rise

- Long Term Care Insurance

- How Technology Can Simplify Healthcare Benefits

- The Case For Innovative Benefits

- Customized Benefits

- How Education Benefits Help Reduce Turnover

- Uber Health

- ERISA Disability Rule Update

- Medicare Advantage Update

- Update on Cadillac Tax

- How Group Critical Illness and Accident Plans Supplement Medical Benefits

- Understanding Health Savings Accounts

- Four Benefit Trends in 2018

- How to Engage Employees in Wellness

- Can Your Technology Platform Accommodate Your Benefit Package?

- How to Enhance Your Benefits Communication Efforts

- Most Popular Employee Benefits

- Should You Still Offer Health Insurance as a Benefit?

- How To Attract Top Talent

- Expensive Benefit Plan Penalties to Avoid

- Conditions That Drive Up Employer Healthcare Costs

- Trends in Company Culture

- Changes in Benefits Offerings

- Repeal and Replacement Prospects for Obamacare

- Recent Developments in Wellness Incentive Programs

- Imputed Income

- Reverse Discrimination in Employer Plans

- The Advantage of Mental Health Benefits

- Healthcare Cost Trend

- Saving For Healthcare Expenses

- Telehealth: Redesigning the Patient Experience

- Vision Exams and Insurance Benefits

- Family Medical Leave Act

- Healthcare Reform Updates

- Disability Insurance

- How to Determine Life Insurance Needs

- Pros and Cons of Bundled Benefits

- Value Based Plan Design

- The Alphabet Soup of Medical Plans

- Medicare

- Retiree Medical Accounts

- Cadillac Tax: Implications and Unknowns

- The Facts About Medical Tourism

- The Buy-Up Solution to Curtailing Benefits

- What You Should Know About Prescription Drugs

- HDHP + HSA: A Versatile Savings Combination

- For Your Benefit: HRA, HCFSA and HSA Plans

- OSHA Proposes Rule Requiring Electronic Submission of Injury and Illness Reports

- Dental Insurance: What You Need to Know

- Voluntary Benefits: Adoption Assistance

- What Is Telemedicine?

- Final Rule Implementing Mental Health Parity Requirements

- Senate Passes Gay Rights Legislation

- IRS Clarifies Transition Relief for Cafeteria Plan Elections

- Changes to “Use-or-lose” Rule for Health Flexible Spending Accounts (FSAs)

- EEOC Settles First Genetic Discrimination Lawsuit

- Supreme Court Strikes Down DOMA, Clears Way for Same-Sex Marriage in California

- Supreme Court Limits Employment Discrimination and Retaliation Claims

- Supreme Court Ruling on DOMA – What It Means for Employers

- The Subjectivity of Employee Benefits

- Model HIPAA Privacy Notices Released

- IRS Procedures to Correct Overpayments on Taxes for Same-sex Spouse Benefits

- Limits on Out-of-Pocket Maximums: Full Compliance Delayed for Some Health Plans

- IRS to Recognize All Legal Same-sex Marriages for Federal Tax Purposes

- Guidance Released on Same-sex Marriage Under ERISA

- Work Is Not a Noun; It's a Verb

- Coping With Flu Season: 3 Tips to Encourage Sick Workers to Stay Home

- Attract and Retain: What Does “Gen Next” Want?

- Retention and Attraction: Cherish or Perish

- The Resilient and the Restless

- How to Attract and Retain Quality Workers in an Environment Poised for Turnover

- A Checklist for Hiring the Very Best Talent

- Employees Make It Clear: Here's What They Need to Really Be Engaged